I think we can all agree that the Government had to do something. Boris Johnson has had his hair cut, and on Tuesday chaired a full meeting of the cabinet for the first time in a year and a half. The proposed changes will be put to the full House of Commons this week. On Weds MPs voted 319 in favour with 248 against, to increase National Insurance. It’s good news that a lot more people are now involved in the decisions that are being taken. However..

Improving(?) Social Care

It is proposed that people will only have to pay a maximum of £86k in care costs from October 2023. Until then it’s unlimited. This cap does not cover food, accommodation or electricity for care home residents! I read that elderly people will still be forced to sell their homes. To reach the £86k threshold care home residents will have spent double that amount when you add in living costs. The £86k will be assessed at local authority prices – usually the lowest available.

People with less than £20k in assets won’t pay at all, and those with £20 – 100k of assets will be means tested and receive part of the money from their local council.

The average length of stay in a care home is two years at a cost of £36k a year. This is a hugely complicated area, so I‘m providing rough and ready figures to give you a basic picture. You can see that the government is excluding most families by setting the maximum payment at £86k.

State Pensions Triple Lock axed for a year

The pensions triple lock was introduced in 2010 to ensure that the state pension automatically increased in line with rising living costs.

State pensions vary between £137 – £180 a week. Not much. The reduced increase of about £5 seems very mean.

Here’s a quote from the Daily Telegraph on 5th September 2021: “More than 1,000 senior civil servants have received six-figure “golden goodbyes” worth over £100 million since MPs passed a law five years ago to outlaw them…”

National Insurance Increase

The Liberal National Insurance Act of 1911 introduced a system of health insurance for industrial workers. In 1943 Winston Churchill promised a combined heathcare, unemployment benefit, and a pensions scheme “from the cradle to the grave” once the war was over. It was the Attlee Labour government who delivered it in 1948.

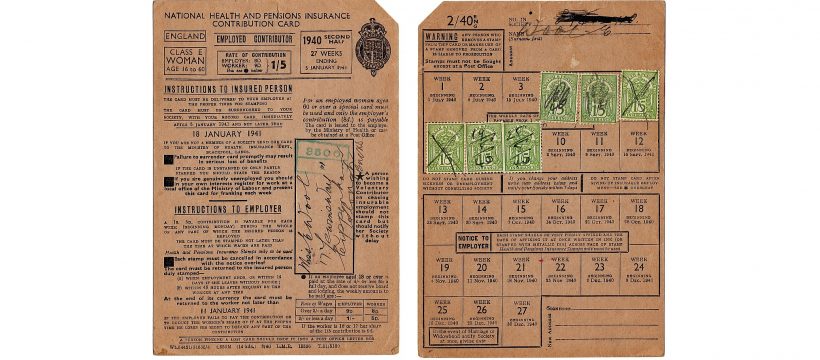

The top photo shows a 1940 National Insurance card with stamps to show payments. It was put into the public domain by the British Government. Up the top left it reads National Health and Pensions Insurance Contribution Card. Insurance.

It is complete nonsense for MPs to try to pick up younger voters by saying that young people should not have to pay for older people’s health and social care costs. My generation of pensioners have been paying this insurance for nearly 50 years. Now we’re older some of us need to make claims.

I started paying National Insurance in 1970. In 1975 5.5% of your pay was deducted for National Insurance. In 2000 the deductions had gone up to 12% for National Insurance.

The government intends to increase National Insurance contributions by 2.5% – the employer pays half, and the employee pays half. If you earn £30k a year you’ll pay £255 a year more and if you earn £50k a year you’ll pay an extra £505 a year etc. 50% of the revenue will be raised from the 14% of higher earners. Pensioners in work will pay the extra £1.25 levy.

The NI increases start next April and over 3 years will raise about £31bn for the NHS and £5bn for social care. So not much money goes towards social care for the elderly. Most of the money goes into the NHS money pit. The NHS immediately said that this is not enough. Today I read that the NHS is hiring 42 new executives for new integrated care boards on salaries of up to £270,000 a year. You couldn’t make this up.

Alan Tucker